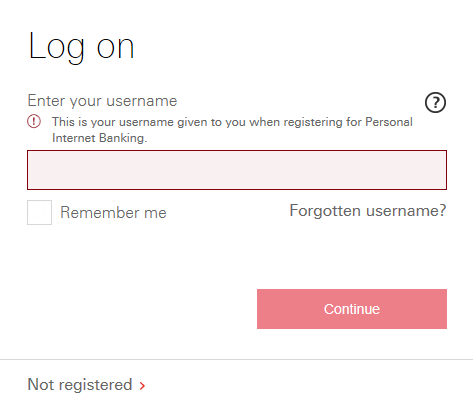

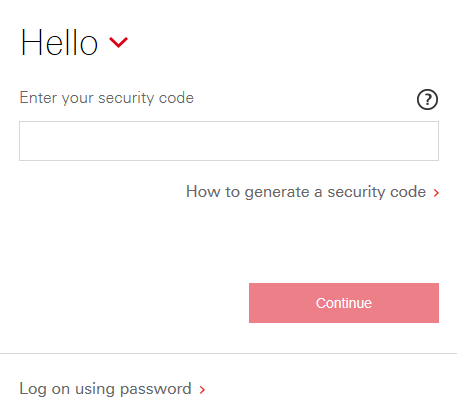

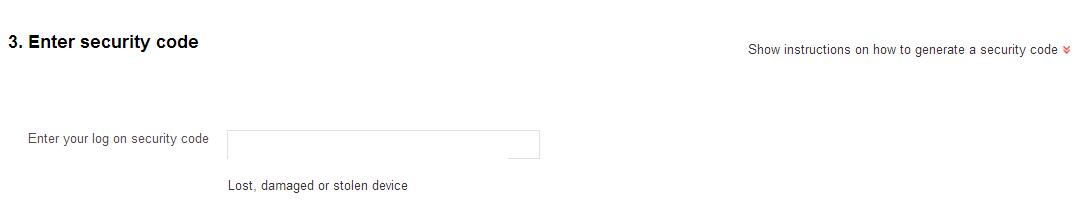

Banking securely with Personal Internet Banking

We recognize how important it is to manage your money online, so we're giving you more options to log on securely.

There are three options to log on and access your accounts online:

- Without a Security Device

- With a Physical Security Device

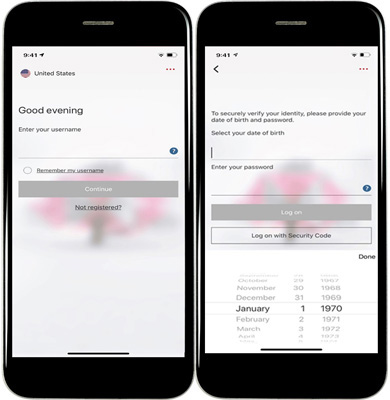

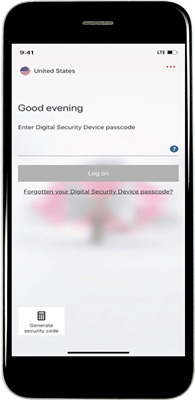

- Using the HSBC Banking Mobile App with a Digital Security Device

Learn more about the steps for each of the three options:

What is a Security Device?

The HSBC Security Device provides an extra layer of protection for Personal Internet Banking and mobile banking transactions. You can either download the Digital Security Device from the HSBC Mobile Banking App5 or we can send you the Physical Security Device by mail.

| Without a Security Device |

With a Security Device |

Using the HSBC Mobile Banking App with a Digital Security Device |

|

|---|---|---|---|

| All you need is |

|

|

Security Device Passcode |

| View account balances and transactions |

|

||

| View checking, savings, credit card and select credit statements using eStatements |

|||

| Move money between your eligible US HSBC deposit accounts |

|||

| Pay bills to existing payees securely and for free |

|||

| View tax form 1099-INT1 when you sign up for eStatements |

|

||

| View copies of your posted check images |

|||

| Access Global View4 |

|||

| Add or modify a payee for bill pay |

|||

| Launch Bank to Bank transfers2,3 |

|||

| Add a country on Global View4 |

|||

| Perform a Global Transfer4 |

|||

| Add or modify a payee for Wire Transfers |

|||

| Initiate Wire Transfers to an existing payee |

|||

| Initiate Wire Transfers to a new payee |

|

All you need is |

|

| Without a Security Device |

|

| With a Security Device |

|

| Using the HSBC Mobile Banking App with a Digital Security Device |

Security Device Passcode |

|

View account balances and transactions |

|

| Without a Security Device |

|

| With a Security Device |

|

| Using the HSBC Mobile Banking App with a Digital Security Device |

|

|

View checking, savings, credit card and select credit statements using eStatements |

|

| Without a Security Device |

|

| With a Security Device |

|

| Using the HSBC Mobile Banking App with a Digital Security Device |

|

|

Move money between your eligible US HSBC deposit accounts |

|

| Without a Security Device |

|

| With a Security Device |

|

| Using the HSBC Mobile Banking App with a Digital Security Device |

|

|

Pay bills to existing payees securely and for free |

|

| Without a Security Device |

|

| With a Security Device |

|

| Using the HSBC Mobile Banking App with a Digital Security Device |

|

|

View tax form 1099-INT1 when you sign up for eStatements |

|

| Without a Security Device |

|

| With a Security Device |

|

| Using the HSBC Mobile Banking App with a Digital Security Device |

|

|

View copies of your posted check images |

|

| Without a Security Device |

|

| With a Security Device |

|

| Using the HSBC Mobile Banking App with a Digital Security Device |

|

|

Access Global View4 |

|

| Without a Security Device |

|

| With a Security Device |

|

| Using the HSBC Mobile Banking App with a Digital Security Device |

|

|

Add or modify a payee for bill pay |

|

| Without a Security Device |

|

| With a Security Device |

|

| Using the HSBC Mobile Banking App with a Digital Security Device |

|

|

Launch Bank to Bank transfers2,3 |

|

| Without a Security Device |

|

| With a Security Device |

|

| Using the HSBC Mobile Banking App with a Digital Security Device |

|

|

Add a country on Global View4 |

|

| Without a Security Device |

|

| With a Security Device |

|

| Using the HSBC Mobile Banking App with a Digital Security Device |

|

|

Perform a Global Transfer4 |

|

| Without a Security Device |

|

| With a Security Device |

|

| Using the HSBC Mobile Banking App with a Digital Security Device |

|

|

Add or modify a payee for Wire Transfers |

|

| Without a Security Device |

|

| With a Security Device |

|

| Using the HSBC Mobile Banking App with a Digital Security Device |

|

|

Initiate Wire Transfers to an existing payee |

|

| Without a Security Device |

|

| With a Security Device |

|

| Using the HSBC Mobile Banking App with a Digital Security Device |

|

|

Initiate Wire Transfers to a new payee |

|

| Without a Security Device |

|

| With a Security Device |

|

| Using the HSBC Mobile Banking App with a Digital Security Device |

To help you get started, choose one of the below options and follow the simple steps.

1 Form 1099–INT is a statement reporting to the IRS interest income you received on checking, savings and investment accounts. HSBC Personal Internet Banking customers will not receive Form 1099-INT in the mail unless specifically requested through a secure BankMail within Personal Internet Banking. Paper versions of Form 1099–INT will continue to be sent by mail for HSBC accounts that do not qualify for online Forms 1099.

2 The following account types are not eligible for online Wire Transfers: Online Payment Accounts and CDs.

3 Your instruction to transfer funds from your account to a third party is a Payment Order. The Bank is authorized, at its option, to charge your account in the amount of any Payment Order and to execute a Payment Order, even if the Payment Order conflicts with any other instructions received by the Bank from you (unless your transfer is a remittance transfer, as defined in Subpart B of Regulation E [12 CFR section 1005.30], in which case additional rules apply which will be provided in the disclosures we give you when you use that service) or results in an overdraft or payment to or for the benefit of a person authorized by you to sign checks or transfer funds for you. If there are not sufficient available funds in your account, the Bank may, without prior notice or demand, charge any account maintained by you with the Bank or setoff against any amount the Bank owes you in order to obtain payment of your obligations. By submitting this form, you are rejecting the Level One Security Procedures offered by the Bank and choosing the Level Two Security Procedures described in the FUNDS TRANSFERS section of the Bank's Rules for Consumer Deposit Accounts, which you acknowledge are commercially reasonable pursuant to Section 4A-202(c) of the Uniform Commercial Code unless remittance transfer rules apply.

4 Global View and Global Transfers are only available for HSBC Premier and HSBC Advance clients and are not available in all countries. Foreign currency exchange rates and local country limitations may apply. Transfers from HSBC accounts from outside the U.S. may be subject to transfer fees. Personal Internet Banking is required to access Global View and Global Transfers. Access to U.S. Personal Internet Banking through Global View from outside the U.S. may be limited.

5 Data rate charges from your service provider may apply. HSBC Bank USA, N.A. is not responsible for these charges.

To qualify for an HSBC Premier relationship with HSBC Bank USA, N.A., you need to open an HSBC Premier checking account and maintain $75,000 in combined U.S. personal deposit and investment** balances OR recurring direct deposits totaling at least $5,000 from a third party to an HSBC Premier checking account(s) per calendar month OR an HSBC U.S. residential mortgage loan with an original loan amount of at least $500,000. Business owners may use their commercial balances to qualify for a personal HSBC Premier relationship. A monthly maintenance fee of $50 will be incurred if one of these requirements is not maintained.

To qualify for an HSBC Advance relationship, you need to open an HSBC Advance checking account and maintain combined U.S. personal deposit and investment** balances of at least $10,000 OR at least $5,000 with a recurring direct deposit from a third party to an HSBC Advance checking account at least once per calendar month OR any HSBC U.S. residential mortgage loan. Business owners may use their HSBC commercial balances to qualify for a personal HSBC Advance relationship. A monthly maintenance fee of $25 will be incurred if one of these requirements is not maintained.

Mortgage and home equity products are offered in the U.S. by HSBC Bank USA, N.A. and are only available for property located in the U.S. Subject to credit approval. Borrowers must meet program qualifications. Programs are subject to change. Geographic and other restrictions may apply. Discounts can be canceled or are subject to change at any time and cannot be combined with any other offer or discount.

**Investments are offered by HSBC Securities (USA) Inc. (HSI), member NYSE/FINRA/SIPC. HSI is an affiliate of HSBC Bank USA, N.A.

Deposit products are offered in the U.S. by HSBC Bank USA, N.A. Member FDIC.